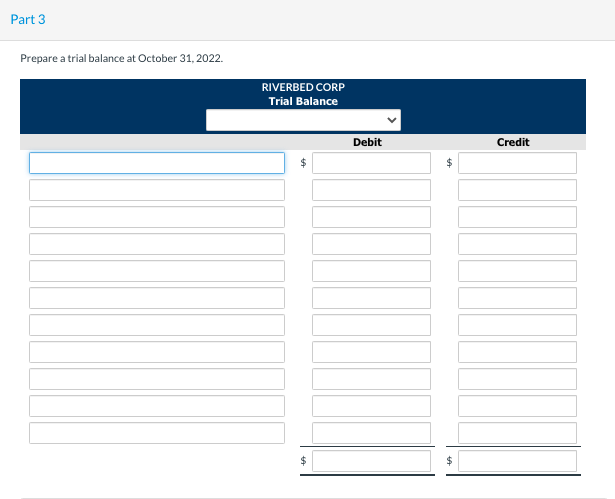

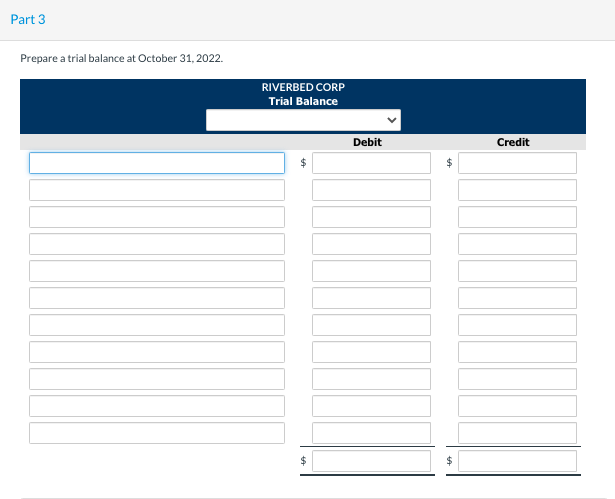

Prepare a Trial Balance at October 31 2022

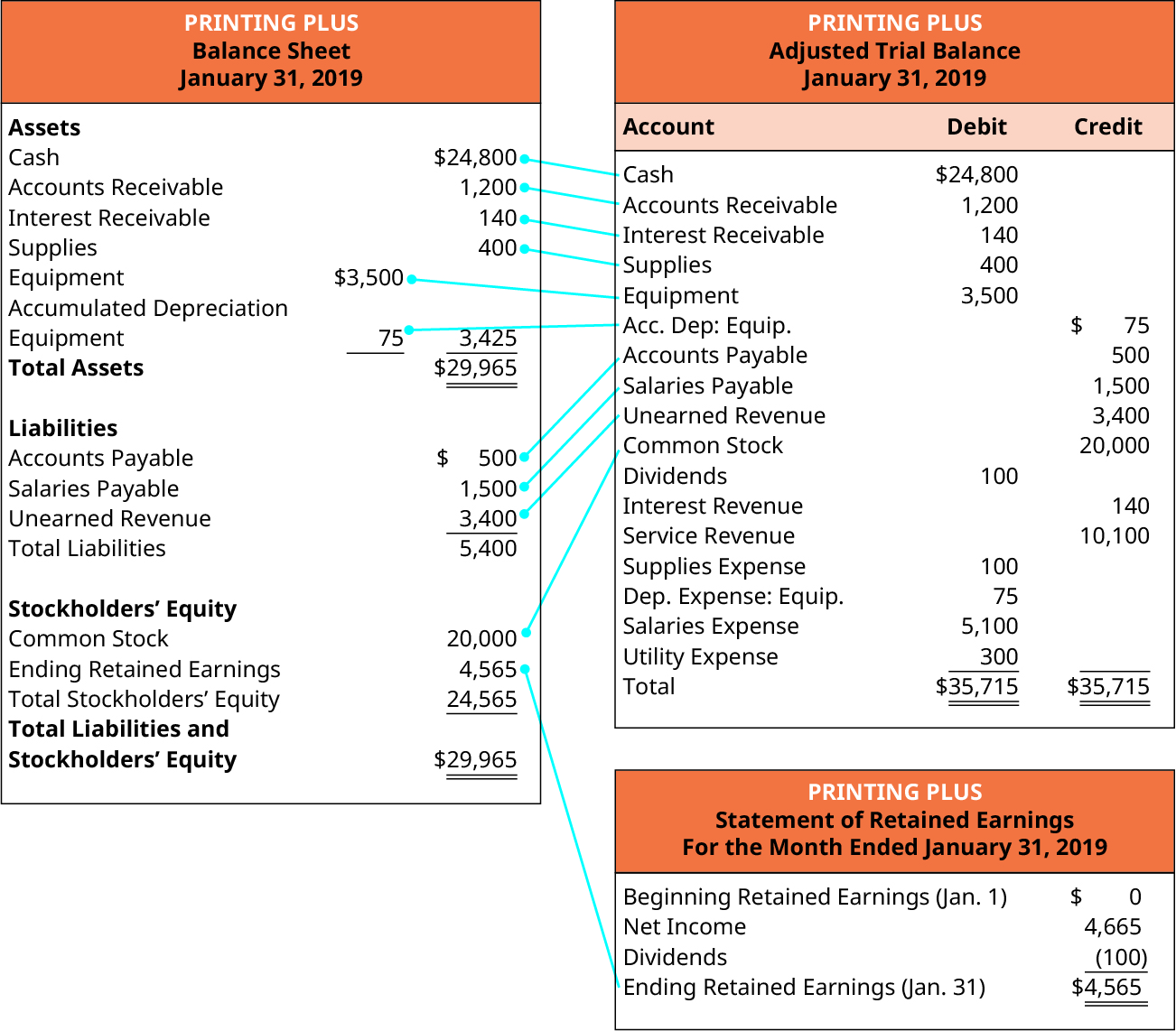

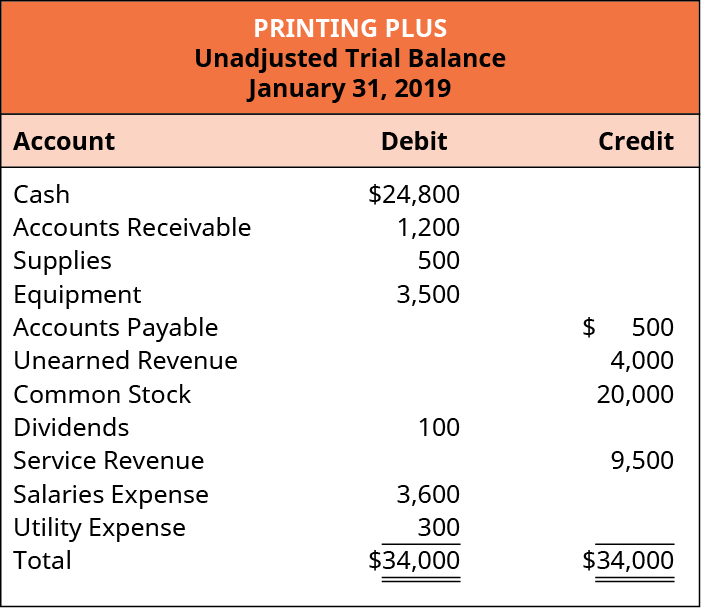

Create an eight-column worksheet with column headers for the account number account name debit total and credit total. Solution for Prepare a trial balance at January 31 2020.

Solved Presented Below Is The Ledger For Higgs Co Cash No Chegg Com

Assume that 28300 of the note payable will be paid in 2021.

. For preparing a trial balance it is required to close all the ledger accounts cash book and bank book first. To prepare a trial balance follow these steps. Prepare a trial balance at July 31 on a worksheet.

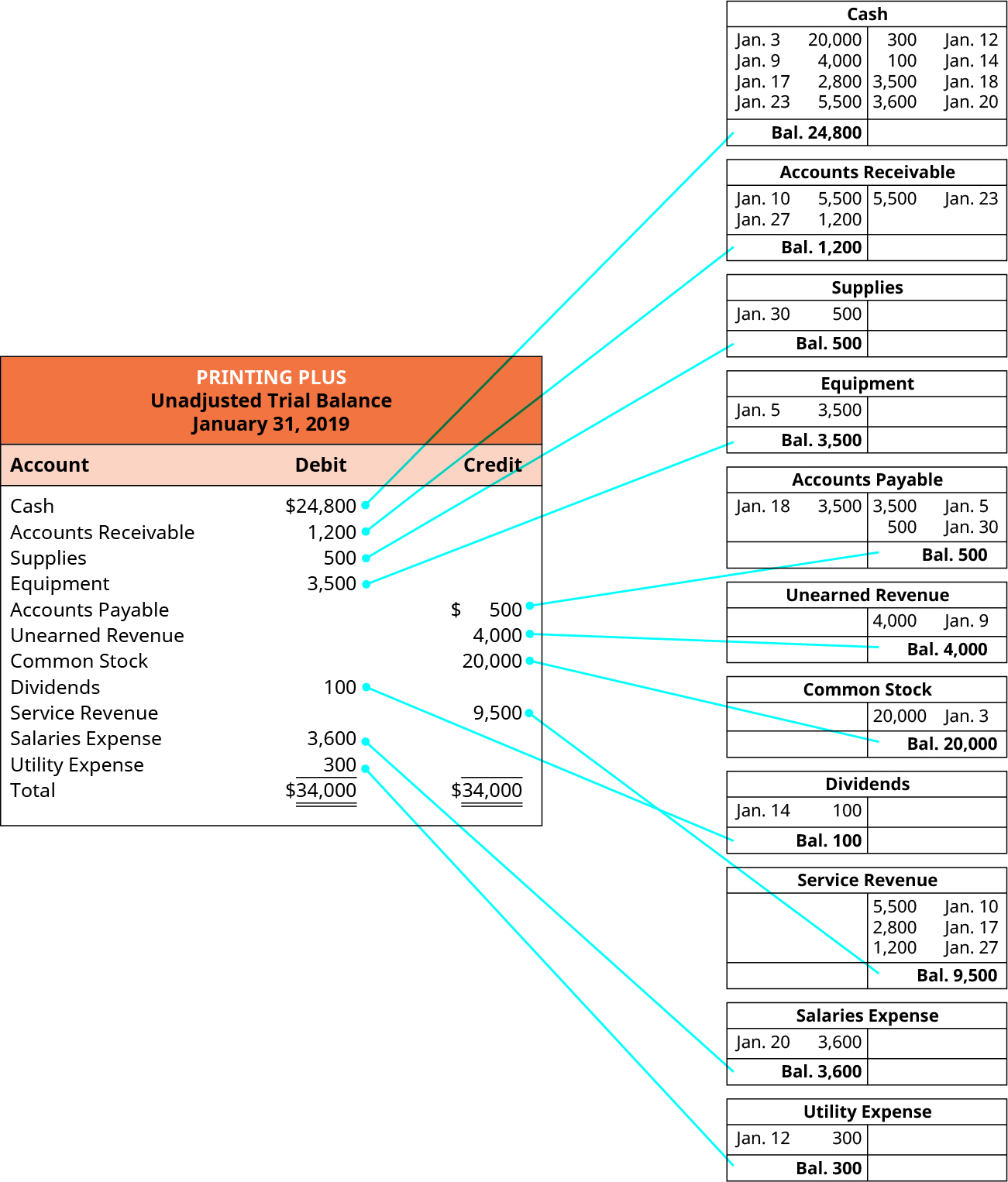

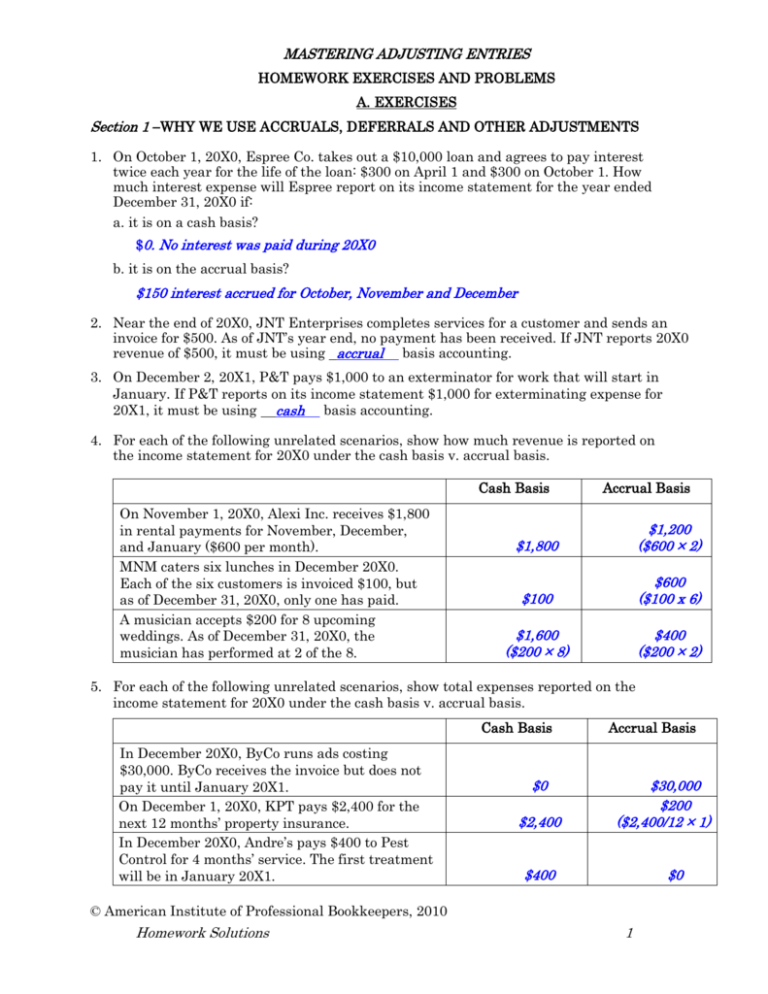

The company borrowed 36000 on March 31 2021. Trial Balance Debit Credit Activate Windows OFU eTextbook and Media Solution Accounts Receivable Oct. The ledger of Perez Rental Agency on March 31 of the current year includes the selected accounts shown below before quarterly adjusting entries have been prepared.

CINELLI COMPANY Trial Balance December 31 2014 Debit Credit Cash 20800 Prepaid Insurance 3500 Accounts Payable 2500 Unearned Service. The owners initial investment consists of. Prepare an unadjusted trial balance as of January 30 2021.

By the end of the year 750 of the services have been provided. Enter the following adjustments on the worksheet and complete the worksheet. 2600 Supplies 101 Bal.

1 Unbilled and uncollected revenue for services performed at July 31 were 2700. Preparing an unadjusted trial balance is the fourth step in the accounting cycle. Use coupon code THD10D2022 valid upto 31 December 2022.

Prepare an adjusted trial balance on May 31. By the end of 2018 only800 of supplies remains. No prior adjustments have been made in 2018.

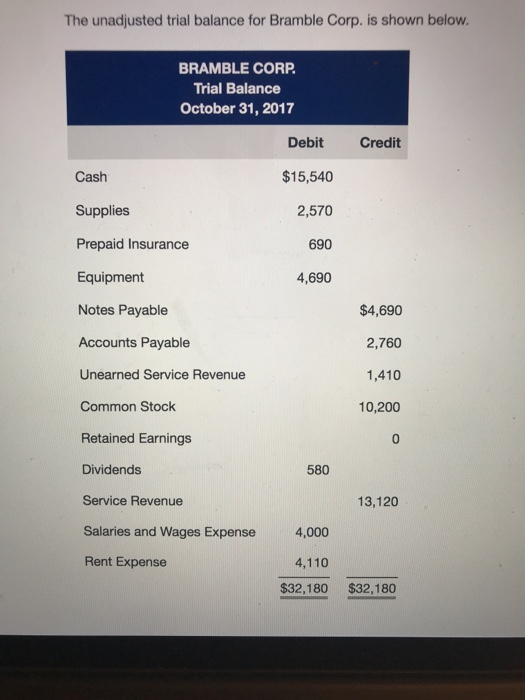

1100 Common Stock 101 Bal. Ledger account should be balanced that means the entries of both debit and credit should be equal. Prepare a trial balance at October 31 2022 BRAMBLE COMPANY INC.

Brief Exercise 3-12 Your answer is correct. 19200 Accounts Receivable 101 Bal. Note that for this step we are considering our trial.

This note is the companys only interest-bearing debt. Your answer is correct. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

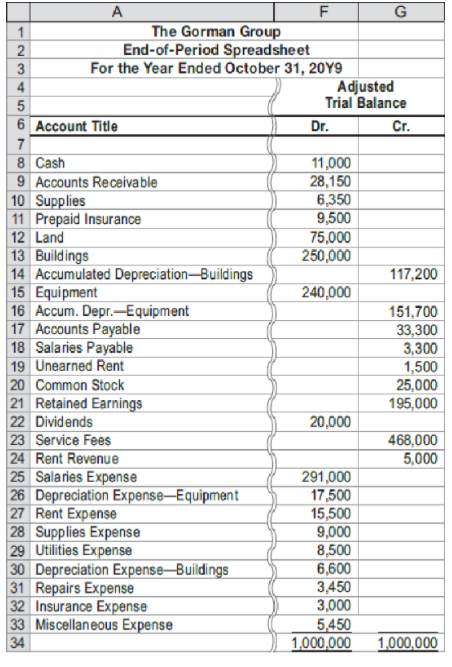

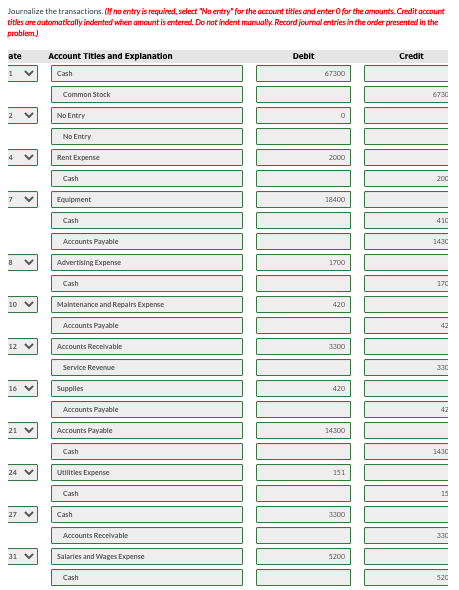

31 Salaries and Wages Expense 4500 4500 Cash Windows Bramble Security Company provides security services Selected transactions for Bramble are as follows. 4800 Unearned Service Revenue 101 Bal. The adjusted trial balance of Oriole Company shows these data pertaining to sales at the end of its fiscal year October 31 2017.

We will add the remaining column titles later. The adjusted trial balance for Pharoah Bowling Alley at December 31 2020 contains the following accounts. From the following balances extracted from the books of Mr.

An analysis of the accounts shows the following. Balance Sheet Assets Liabilities and Stockholders Equity 24 24 24 METLOCK INC. Rasool started a courier.

Sales Returns and Allowances 20600. C What is the amount of profitloss for the month of January 2020. The balance of Deferred Revenue 2600 represents payment in advance from a customer.

Commissions due from Roads 10120 not paid by Roads at this time10Receives cash of. Total of Trial Balance353400. Retained earnings oct 31 19800 Common stock 31000 Accounts payable 6100 Equipment 31000 Service revenue 26000 Dividends 5100 Insurance expense 3600 Cash 12900 Utilities expense 900 Supplies 2400 Salaries and wages expense 8000 Accounts receivable 10600 Rent expense 2600.

Trial balance is prepared after the transactions are first recorded in the journal and then subsequently posted in the general ledger. Also assume the following. Principal and interest are due on March 31 2022.

And Sales Discounts 14900. 15000 Retained Earnings 101 Bal. Update account balances for the year-end information by recording any necessary adjusting entries.

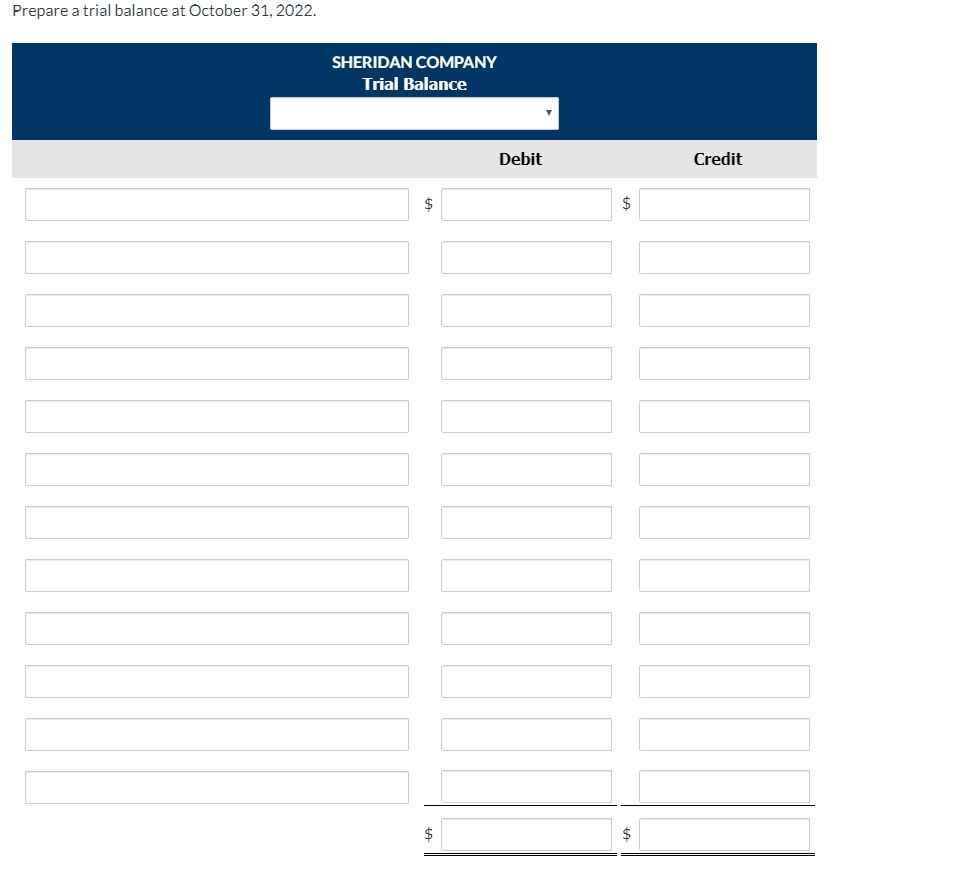

On October 31 2021 Eldorado lent money. Prepare a correct trial balance assuming all account balances are normal. Income Statement For the Month Ended October 31 2022 Revenues Service Revenue 20500 Expenses Interest Expense -370 Salarles and Wages Expense -2900 Supplles Expense -450 Depreclation.

8000 Accounts Payable 101 Bal. Enter the opening balances in the ledger accounts as of October 1. 3 One-twelfth of the insurance expired.

11000 Your answer is correct. 2 Depreciation on equipment for the month was 500. Prepare a classified balance sheet.

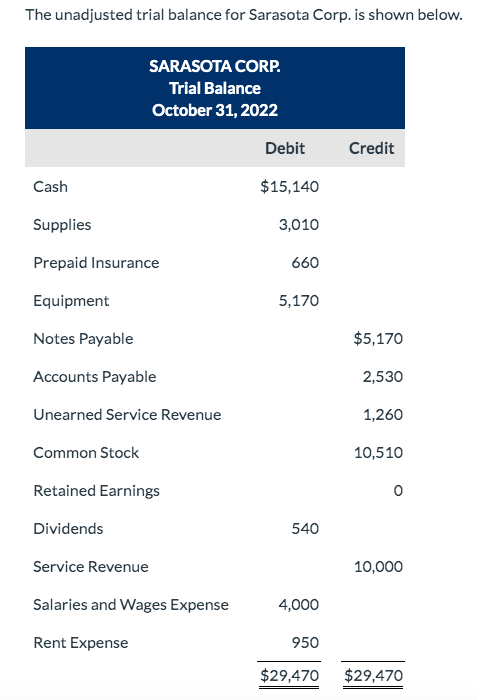

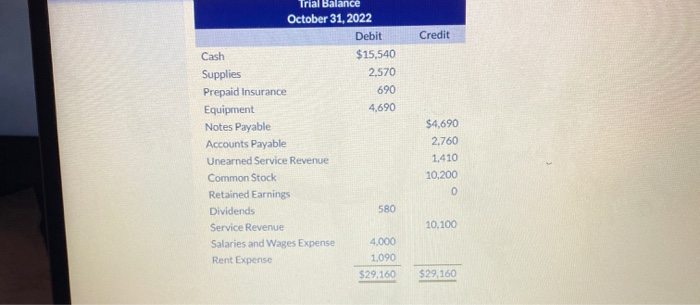

B Determine the October 31 balance for each of the accounts above and prepare a trial balance at October 31 2015. The balance of Prepaid Rent 7200 represents payment on October 31 2021 for rent from November 1 2021 to April 30 2022. Prepare a trial balance at October 31 2022.

An inexperienced bookkeeper prepared the following trial balance that does not balance. The rent is paid in advance. Prepare the sales section of the income statement.

Closing Stock 10000 Cash in hand 14200 Outstanding Expenses 4400 Prepaid Expenses 1400 Accrued Income 3000 Cash at Bank 16800 Bills Receivable 28000. The balance of Deferred Revenue 3000 represents payment in advance from a customer. Prepare a balance sheet at October 31 2022.

By the end of the year 650 of. Prepare a balance sheet as of October 31 2022. The balance of Prepaid Rent 6720 represents payment on October 31 2021 for rent from November 1 2021 to April 30 2022.

2100 Equipment 101 Bal. Prepare an adjusted trial balance as of December 31 2018. A trial balance is an important step in the accounting process because it helps identify any computational errors throughout the first three steps in the cycle.

These cover the initial entries into the spreadsheet. Preparing A Trial Balance Assignment Help. Rent for the year on the companys office space is 24000.

SOLO HOTEL Adjusted Trial Balance May 31 2014 Debit Credit Cash 2684 Prepaid Insura 1350 Supplies 1057 Equipment 16800 Land 15184 Buildings 71200 Salaries and W 3680 Utilities Expens 800 Supplies Expe 1543 Insurance Exp 450 Interest Expen 186. 1Stockholders invest 30300 in exchange for common stock of the corporation2Hires an administrative assistant at an annual salary of 314403Buys office furniture for 3730 on account6Sells a house and lot for E. List assets in order of liquidity METLOCK INC.

Into a Trail Balance at 31 March 1999. PK prepare Trial Balance as on 31st March 2021. ERNST CONSULTING Balance Sheet As of October 31 Assets Liabilities Cash 9750 Accounts payable 8900 Accounts receivable 15600 Office supplies 3710 Office equipment 18450 Equity Land 45970 Common stock 84470 Retained earnings 110 Total assets 93480 Total liabilities and equity 93480 8.

Solved The Unadjusted Trial Balance For Sarasota Corp Is Chegg Com

Solved The Unadjusted Trial Balance For Bramble Corp Is Chegg Com

Credit Trial Balance October 31 2022 Debit Cash Chegg Com

Solved Part 3 Prepare A Trial Balance At October 31 2022 Chegg Com

Question 5 Trial Balance Of A Business As At 31st March 2018 Is Given Below Prepare Trading And Brainly In

Acct 201 Midterm Flashcards Quizlet

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Acct 201 Exam 2 Flashcards Quizlet

Acct 201 Exam 2 Flashcards Quizlet

Acct 201 Midterm Flashcards Quizlet

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Solved Here Is The Ledger For Sheridan Company Cash Oct 1 Chegg Com

Answered A The Gorman Group End Of Period Bartleby

Solved Part 3 Prepare A Trial Balance At October 31 2022 Chegg Com

Trial Balance Of A Business As At 31st March 2019 Is Given Below Prepare Trading And Profit Youtube

Acct 201 Exam 2 Flashcards Quizlet

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment